Floating wind can power UK to net zero and lots of UK jobs!

There’s so much potential for floating wind power that it could provide the UK with as much energy as it is ever likely to need. Plus more. The costs are still uncertain, but there is plenty of room for cost reductions.

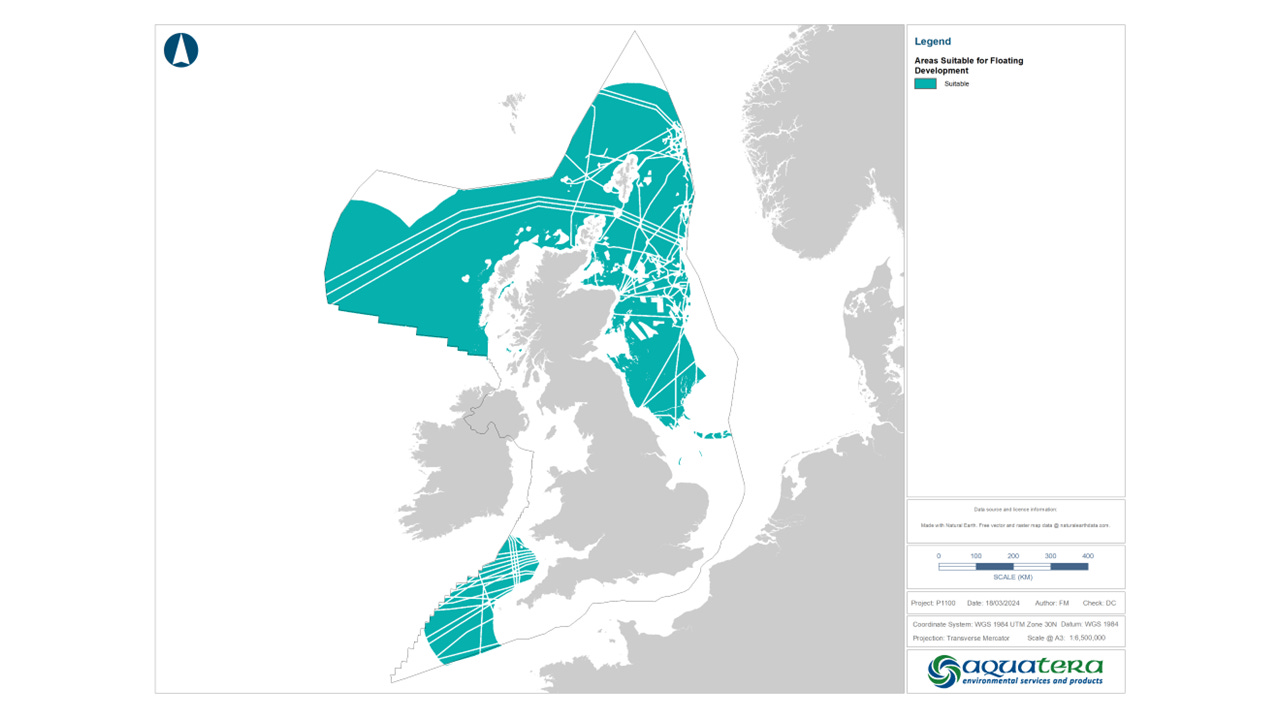

You can see the areas suitable for (the now conventional) fixed-bottom offshore wind turbines in Figure 1 below. It is generally assumed that waters up to 60 metres in depth may be suitable for fixed bottom designs. Floating offshore wind farms (FLOW) are generally assumed (in the industry) to be the answer for depths greater than 60 metres. If we include potential area for FLOW the UK offshore wind output potential increases by a factor of more than three times compared to just fixed-bottom wind. You can see the potential area for FLOW in Figure 2.

Figure 1 Potential areas for cover by fixed bottom windfarms

Source: ‘Floating Wind: Anchoring the next generation offshore’ published by RenewableUK, October 2024 (see HERE), and reproduced with their permission

Figure 2 Potential areas for cover by floating wind

Source: as in Figure 1

In sum, around three-quarters of the technical potential for offshore wind involves floating offshore wind farms. Indeed, all offshore wind, both floating and fixed-bottom, could provide more than 2100 TWh of UK electricity, according to this analysis produced by the renewable energy trade association RenewableUK (see HERE). Currently total UK electricity generation is around 300 TWh per annum. The Committee on Climate Change has projected that around 645TWh of electricity generation will be required for a net zero scenario by 2050.

Onshore wind and solar farms are the cheapest large-scale source of renewable energy. Hence, in practice, not all of the UK offshore wind resource will be needed to provide all UK energy requirements. This is because onshore renewables will provide a substantial proportion of energy needs. However, large amounts of floating wind will still be important.

Costs of floating wind compared to other renewables

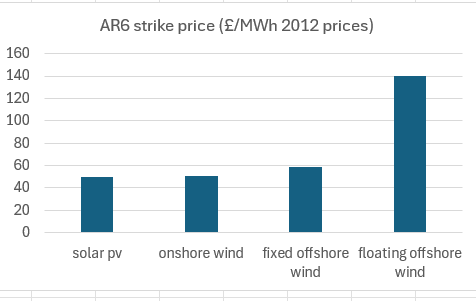

We can see at the moment (as shown in Chart 1) that the costs of floating offshore windfarms are higher than other renewable energy options. This shows prices of contracts-for-difference (CfDs). CfDs are 15 year contracts issued by the UK Government that involve guarantees of payment of fixed prices for each unit of power generated.

Chart 1

Comparison of top prices of different renewable energy options according to the UK Government’s September 2024 contract auction results

Source of data HERE

It can be seen from this chart that floating offshore wind is (currently) a lot more expensive than fixed-bottom offshore wind. However, we should be wary of underestimating the potential for cost-reduction of FLOW. Let us go back to the very first auction of UK CfD contracts done in 2015 and compare the top prices awarded then with the top prices set in 2024. This is shown in Chart 2, minus prices for FLOW which was not an auction contender in 2015.

Chart 2

AR1 and AR6 strike prices compared (£/MWh 2012 prices) - Top prices awarded to the different technologies (FLOW not included then).

Source of data: as with Chart 1 and also HERE

Two things are notable in this comparison. The first is the steep decline in costs for all of the technologies - 50% in the case of offshore wind, and around 40% for both onshore wind and solar PV. But the second notable fact is that the prices for offshore wind (all fixed bottom projects) in 2015 are not too far below the price given to the FLOW project in the 2024 auction. Hence when the development of FLOW follows the trajectory of fixed-bottom designs we may expect a similar profile of cost declines.

One thing to remember is that in volume terms, in 2015 there were already over 5GWe of (fixed bottom) offshore projects deployed in the UK, whilst in 2024 there is less than 100 MW of floating offshore wind projects. Fixed-bottom offshore wind has been developing over the last quarter of a century in the UK and in 2023 it generated around 17 percent of UK electricity.

FLOW technology, in 2024, is subject to considerably less development compared to offshore wind in 2015. Therefore FLOW technology has had much less chance for gaining more industrial maturity and thus less chance for cost reduction compared to fixed-bottom technology. Hence this historical comparison would, on the face of it, leave considerable room for hope that FLOW costs will decline in similar fashion to that of the fixed bottom offshore wind technology.

Photos of some different designs

See below photographs of three different (models of) designs for floating offshore windfarms. The photos were taken (by myself) at the Floating Offshore Wind Exhibition organised by RenewableUK in Aberdeen in October 2024.

Although first impressions may suggest that a floating design will have less underwater weight compared to a fixed bottom design, in fact, the opposite is the case. That is, at least in the designs under consideration now. That is because of the anchoring and in many designs mooring requirements of the system design, which weigh a lot. An additional factor is that the floating wind farms will have a much greater reliance on the development of port complexes to build the floating wind turbines (or sets of turbines) before they can be towed out to the site.

Of course, it is plausible to argue that FLOW technology today is cumbersome and difficult to develop at prices comparable to the fixed-bottom technology. On the other hand, I distinctly remember going to a wind industry Conference around 2010 and hearing a representative of one of the leading (fixed-bottom) offshore wind developers saying that they did not know of any great possibilities of cost reductions - other than optimsation of electrical connections. That, of course, has proved to be wrong.

One possibility is that the conventional wind turnone design may be abandoned in favour of one that suits floating offshore wind. The key thing is to reduce the platform and anchoring weight. Having a design with a certical axis may be a big help since this will reduce the centre of gravity of the machine. See HERE.

Floating wind - possibilities for reducing costs

Floating wind is a technology that has only seen a few projects implemented throughout the world to date. There are only two projects in the UK. Both of them are sited off the East coast of Scotland, with a combined capacity of around 80 MW. In addition to this two CfD contracts have been issued, one for the Wave Hub project of up to 40 MW (South West England) and the second for the Green Volt project (North East Scotland) of up to 560MW. Depending on the speed of development of the Hainan floating wind project in China, this (Green Volt) project may become the largest floating wind project in the world. However there are already several GWs of floating wind projects (proposed in the UK) that are awaiting planning consent.

Clearly, though, floating offshore wind is an immature technology compared to fixed-bottom offshore wind. Monopile designs have become the dominant design for (fixed-bottom) offshore wind farms. Monopiles involve large tubular columns fixed to the bottom of the water.

By contrast in the case of floating wind, nobody has a clear idea of which out of several (currently) proposed design types is likely to become the industry leader. Despite a superficial similarity, it could be argued that floating wind is as far removed from fixed bottom designs as fixed bottom designs are from onshore wind.

Representatives of FLOW developers I have spoken to look towards at least a 40% reduction in current FLOW costs, and maybe even, someday, parity with fixed bottom technology. The key to advances will no doubt involve four things apart from anything else. First, the preparation of new designs and material combinations that involve less underwater weight - which probably overlaps mostly with the second: a reduction of the weight of the turbine and nacelle itself (relative to the size of the blades) so as to allow a reduction in anchoring weight. Third, optimising port and supply chain infrastructure. Fourth, improvements in the efficiency of wind capture through longer blades, better blade design and better machine controls. Of course some of these points also apply to the other forms of wind power as well!

UK taking the lead

The UK appears to be leading the world in this new floating technology. The largest capacity of projects is being proposed off the coast of north and east of Scotland. The biggest proposal so far is the 2300 MW Arven project to the East and North of the Shetlands.

The planning for this and other large proposals are being coordinated by the Scottish Government which has issued leases for a large capacity of potential floating offshore wind projects. It is unclear yet where the port and construction facilities will be based for the various Scottish floating wind schemes. However, the Cromarty Firth (on the Moray Firth in North East Scotland) seems to be the likely area for most development (see HERE).

The Westminster Government is also issuing leases for floating offshore sites in the ‘Celtic Sea’. This is defined as off the coasts of southwest Wales and west England. Port Talbot has been earmarked as suitable for floating offshore wind construction.

Congratulations to the UK Government for their boost to floating offshore wind power in Aporil 2025, in which £300 million has been put into floating wind innovation through GB Energy. See HERE.

Jobs for the UK

Although there has been criticism of how jobs in UK renewable energy have often gone elsewhere, two factors are likely to mean much more UK job concentration (potentially many tens of thousands of jobs) in the case of floating offshore wind than earlier renewable energy projects (see HERE). The first is that the very nature of FLOW technology puts a premium on the port facilities being as close as possible to the sites themselves. The second is that the UK’s contract-for-differences (CfD) procurement system has been changed, to encourage more jobs to be based in the UK.

Although not formally labeled as prioritising ‘local content’ ( which potentially breaches international trading standards), in fact, holders of CfDs will be under pressure to locate construction and supply chain work in the UK. This is because tenders for CfDs have to contain statements describing from where the work is to be procured. Developers will feel that they will, in effect, have to stress ‘local content’ to maximize their chances of securing deals from the Government.

This seems to be implicit in the ‘supply chain guidance’ (see HERE) issued by the Government. This includes a range of requirements. One notable requirement (in supply chain plans) is the objective of ‘developing a diverse, skilled workforce and increasing employment opportunities, while ensuring the renewable energy industry reflects society as a whole and operates ethically and safely’. (page 6).

The future

Funding innovation has been an essential task in building renewable energy technologies this century. Don’t listen to the detractors about the ‘expense’. As has been shown with conventional wind and solar power, the technology costs have been driven downwards by early investment in the technology which has created markets for the technologies. The same will happen with floating offshore wind.

It seems likely that, over the next few years, the Government will continue to give out more contracts to fixed-bottom offshore wind farms relative to floating. However, in the future, this proportion will change. The speed at which electricity consumption increases because of decarbonisation is also a factor, but the biggest factor is the speed by which FLOW costs reduce. There is little doubt in my mind that the costs of FLOW will come down greatly, both in absolute terms and also relative to other renewable energy sources. However, it may be quite some time before floating wind manages to catch up with declines in costs of fixed-bottom windfarms.

In other countries, demand for floating offshore wind farms will vary according to the level of onshore renewable resources and coastal water depths. Certainly, countries such as Japan could have a strong incentive to develop FLOW since their onshore renewable resources may be relatively meager and their offshore waters are deep. The UK, then, could develop its economy by both building floating offshore wind at home but also by offering expertise on the subject abroad.

New developments can reduce costs eg. single mooring point around which a floating turbine swivels to catch the wind. The narcelle does not rotate, so no yaw drive or motor, the various floating foundations, some with tension structures are up 4 to 8 times lighter than most current spar and semi-submersible floating foundations . There are number of EU programs to see if this is worthwhile, cost reductions, varying wind and wave directions, reduced output, etc.

X1 Wind floating turbine with one point mooring https://www.x1wind.com/x1wind-technology/

Aerodyn Nezzy 2 x 7.5 MW innovative (15MW) floating twin turbine with one point mooring (no yaw control/motor) http://aerodyn-engineering.com/scd-technology-scd-nezzy/

Hexicon TwinWind 2 x 3-15 MW innovative (6-30MW) floating twin turbine with one point mooring (no yaw control/motor) https://www.hexicongroup.com/twinwind/

Mingyang OceanX 2 x 8.3MW (16.6MW) floating offshore wind turbine with tensegrity structure and one point mooring (no yaw control/motor) but 2 blades broke before it was installed !!

https://reneweconomy.com.au/mingyangs-two-headed-floating-wind-turbine-begins-operations-despite-fractures-in-giant-blades/

Touchwind single horizontal/tilted rotor with now semi-submersible, probably tension leg 3 point mooring floating foundation (no yaw control/motor) https://touchwind.org/

The extraction of wind energy in such a large scale will change the weather and climate. Since extracting energy from the airflow reduces inevitable the air flow. Therefore the transport of moisture from the sea to the continents and the balancing of temperature differences is reduced. Probably it will even change the atmospheric current pattern, air flow is preferred, which circumvents the energy sink of the wind turbines. So a large scale energy generation by wind turbines will inevitable result in more droughts and more weather extremes. So large scale wind energy generation will result in a human-caused climate change. A detailed calculation of the maximum extractable wind energy can be found in the publication from Axel Kleidon: "Physical limits of wind energy within the atmosphere and its use as renewable energy: From the theoretical basis to practical implications" Meteorol. Z. (Contrib. Atm. Sci.), Vol. 30, No. 3, 203–225 (2021). According to this publication only 0,6 W/m² wind energy can be generated (average over large area). Independent of the construction of the wind turbines. And is obvious, that the influence on the atmospheric circulation will increase as the local energy extraction converge to this limit. Therefore I would estimate that the energy extraction should be blow 5% in order to limit the climatic impact of the wnd energy generation. Which corresponds to an energy generation of about 0,03 W/m² or about 67 TWh/year for GB, which is far below energy demand of an industrialized GB.