How falling battery prices and renewables will slash electricity bills

As I explain later in this post, UK electricity is currently expensive primarily because gas-fired stations are setting high prices. This is made worse by the lack of competition with gas to provide balancing for renewables and other fuels. But this can, and will, change as the influence of batteries increases to provide more competition. On top of this, new renewable energy schemes are and will be installed at ever cheaper prices. New wind and solar plants are already being installed at prices considerably lower than current prices for electricity supplied by gas. As a result, electricity prices should fall by around a quarter.

In this post, I shall look at how electricity prices are high in 2025. Then I shall discuss the much-undermentioned, but in the future, extremely important, role of batteries in reducing electricity prices. Essentially, the outlook is looking promising for a renewables-based electricity system to provide increasingly reduced prices with much less volatility than a system based on fossil fuels.

I point out some undeniable trends and use some conservative assumptions about cost declines in renewable energy to produce a projection that electricity prices should fall by at around a quarter by 2038. In the shorter term, of course, electricity prices could also fall by large amounts, but that partly depends on whether prices fall on the international liquefied natural gas (LNG) markets. Prices in these markets are volatile.

Why are electricity prices high?

The association between wholesale gas and electricity prices is a close one. Wholesale gas prices and electricity prices are still well ahead of what they were in 2018/2019 (before COVID and then the Ukraine War). This can be observed from looking at OFGEM’s historical price records. This can be seen HERE (see ‘Wholesale Day Ahead Contracts Price Trends’).

A historical comparison of consumer gas and electricity prices is reproduced below, in Figure 1. This Figure uses inflation-adjusted price indices published by the UK Government. As can be seen, electricity prices peaked in 2022-23 in line with the worst of the gas price crisis that was linked to the Ukraine War.

At the time (2023) consumers were protected from the worst effects by the Government. They spent very large sums of state money in consumer protection. This spending stopped as prices subsided a little. As a result consumers did not directly feel the benefits of the energy price drops. However it is clear that the link between electricity prices and gas prices (set by world liquified natural gas prices) is strong given the association between the fall in gas prices and the fall in electricity prices in 2024. Gas prices are still well above the levels of gas prices in 2018-19, as can be seen in the graph.

Figure 1

The Govt indices reflect the 'total cost' to consumers. See the series published HERE.

Gas-fired power plants are the ‘marginal’ generators that set prices for all generators in the wholesale electricity power market. Electricity is bought and sold in half-hour packages. Suppliers buy enough electricity that is required to satisfy demand in each half hour. Those generators making the highest-priced successful bids set the prices that all generators receive. Even though gas power plants form a declining total of annual electricity supplied, they still usually set wholesale electricity prices. In 2021, gas set the UK electricity price for 97-98 percent of these half-hourly trading periods (see HERE, also HERE. This proportion will decrease over time as renewables penetration grows. This decrease will be much helped by the deployment of batteries.

There is also a ‘balancing mechanism’. The National Electricity System Operator (NESO) buys power to plug gaps not filled by the main wholesale market. Gas power plants dominate the balancing market, and sometimes, the gas power plants are paid extremely high sums per MWh to provide balancing services.

As Adam Bell from Stonehaven thinktank says: ‘The absence of coal - even with relatively healthy capacity margins - handed considerable market power to gas-fired power plants, and although gas still sets the price of power, it does so at a heftier margin than in the 2010s. One can observe this by looking at the gross profits of Uniper UK, whose primary business is running gas power plants (see HERE).

So, essentially, there are two problems here. The first is that we depend on the international LNG market to set the price of gas for Europe in general. These prices may fall over the next couple of years. However, they may (then) rise again. We just do not know. The second problem is that gas power does not have sufficient competition in the electricity markets. Can batteries provide this competition in the future? My answer is definitely yes.

New renewable energy sources are cheaper than power from the gas-fired power plant, which sets the wholesale price most of the time. In 2024-2025, wholesale power prices are averaging around £90 per MWh (see HERE). Meanwhile, the most recent contracts for difference (CfDs) for solar PV and onshore wind power have been allocated at around (in current prices) £70 per MWh and £80 per MWh for fixed offshore wind. CfDs guarantee developers a fixed price for each MWh of power generated over 15 years.

Renewables are getting cheaper, so the future direction should be towards cheaper electricity. The development of a large capacity of batteries will mean that these cheaper renewables can dominate price making in electricity markets, either directly or indirectly through batteries. The batteries can use energy sourced from renewables to provide effective competition with the gas generators.

Legacy costs for renewable energy

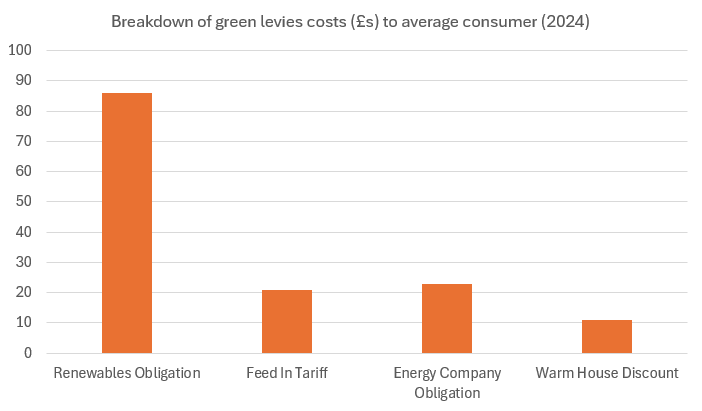

The ‘legacy’ costs for renewable energy are mostly paid through the so-called green levies. The cost of the Feed-in tariffs (mainly for building-based solar PV and some small wind power) and the Renewables Obligation (RO) (mainly for the first large-scale windfarms) comes out of the green levies. As can be seen in Figure 2, the RO takes up around 60 per cent of green levies (about £86 on the average bill in 2024), with the FITs costing £21. Other items include insulation schemes and payments to fuel-poor consumers (Warm Home Discount), which pay more for gas consumer services rather than electricity consumers. The total cost of the green levies constituted around 16 per cent of the average consumber elec tricity bill in November 2024 (See HERE).

Figure 2

Source: Energy and Climate Intelligence Unit (ECIU), see HERE

How electricity costs will fall

I assume that the current Government’s target for 95 per cent of electricity generated from what it defines as clean sources is maintained through 2038. This includes an expansion of electricity demand to cope with increasing decarbonisation of heat and transport. This would involve continued allocation rounds issuing sufficient capacities of CfDs to renewable projects. Recent and future renewable energy projects are substantially cheaper than power from gas.

The wholesale power price fall as renewables form the ‘margnal’ power price (that sets all wholesale power prices at any one time) more often. On top of this less demand for gas power means that demand for gas will be relatively less on international gas markets. This will lead to lower gas prices.

There are legacy costs in consumer bills for older, more expensive, renewable energy projects. The RO costs will begin to decline in 2027 as the first renewable energy projects reach the end of their 20-year CfDs for guaranteed payments, and end completely in 2037. By 2038, most of the FIT costs will also have expired. The legacy costs associated with the CfDs (the scheme that superseded the RO for funding renewables) make up a very small part of wholesale power costs. The CfD schemes that add costs to consumer bills will mostly be out of contract by 2038.

In the future, the deployment of batteries will reduce both the wholesale power costs (which make up nearly half of the 2025 electricity bill) and also balancing costs. Cheaper renewables will also act to reduce the wholesale power costs.

Figure 3

Source: UK Government CfD auction results reports and own calculations for future projection

Figure 3 compares the past level of the price of CfDs offered for renewable energy with a conservative estimate of cost reductions in the future. I base this projection on an analysis of likely declines in wind power costs by researchers led by Ryan Wiser of Lawrence Berkeley National Laboratory (see HERE). Declines in the cost of solar PV are likely to be at least as big as this, if not larger, considering historical declines in cost of solar PV.

Although many tout nuclear power as an answer to so-called ‘intermittency’ issues, in fact nuclear power is unqualified to help. It is inflexible in operation. Indeed, the contract given to Hinkley C nuclear power station encourages production for as much of the time as possible, even when power prices are negative.

Fortunately, batteries are coming to the rescue. Batteries will greatly reduce the costs of the electricity system. The capacity of grid-connected batteries is set to increase rapidly.

The battery revolution

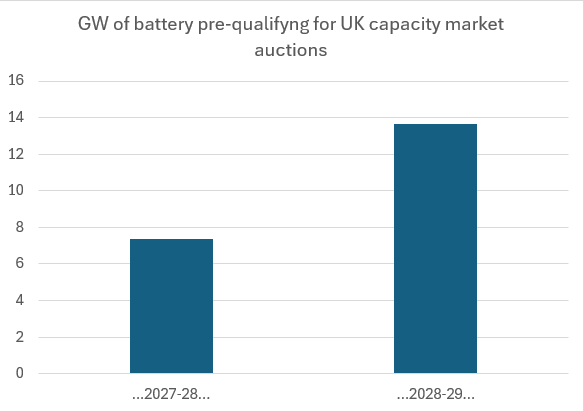

So far batteries have made very little difference to electricity prices because the grid-connected quantities are small in capacity and duration. However, things are changing fast. As can be seen in Figure 4, there is a rapid increase in the capacity of batteries qualifying for Government auctions to supply balancing power. These are the ‘T4’ auctions through which power stations and increasingly, batteries compete for payments to supply capacity for the grid for four years ahead.

Figure 4

Source: Montel see HERE Note: nominal battery capacity shown here is ’derated’ by large amounts to make it equivalent to the capacity supplied by a conventional power plant. Derating takes into account the duration for the battery can supply its capacity

In 2028 batteries will be making a difference since they will be making up approaching 10 per cent of the capacity that is ‘hired’ by NESO. However, this proportion will rise rapidly thereafter. According to a report by RenewableUK, the UK grid-scale battery pipeline has grown to around 96 GW (see HERE). The numbers are increasing by around 10 GW a year. If all of the 96 GW was operationalised that would make up the equivalent of 70 per cent of the capacity that is sought by NESO in its T4 auctions.

The effect of incorporating the increasing amount of battery capacity will be to reduce electricity prices in two ways. First, it will offer competition to gas generation in the general wholesale power market, and second, it will compete with gas generation in the balancing market itself. This will enable the electricity system to deliver power at close to the (declining) costs of renewable energy.

The role of batteries is systemic. It is wrong to posit batteries as adjuncts of specific renewable energy schemes, as some analysts have tended to do (although some can be profitably associated with specific projects). Batteries would make a system consisting entirely of fossil fuels deliver electricity at much cheaper prices. They also reduce the amount of peak generating capacity that is needed by evening out the need for load throughout the day.

Batteries receive income in three ways: by providing capacity to the system, by ‘arbitrage’ in absorbing power when prices are low and selling when high, and in providing 'frequency response’ and other fast response grid services.

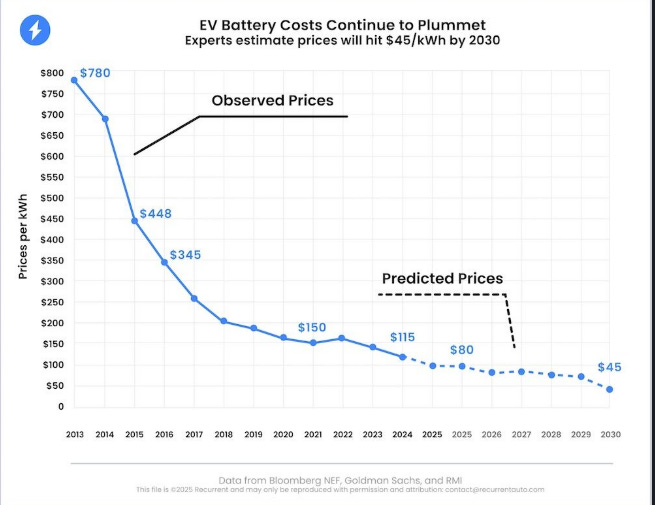

Of course, batteries are especially suited for an electricity system that is mostly consistent of fluctuating renewables. The emerging battery revolution is made possible because of the rapid decline in battery costs. This is shown in Figure 5.

Figure 5

Source: Joe Romm, Former Acting Assistant Secretary of Efficiency and Renewables, US Federal Government, see HERE

Falling electricity prices

So, how do these developments, ie, continuing the renewable energy deployment and the rapid increase in the number of batteries, change the electricity price profile? This will lead to reduced costs for both wholesale power and balancing services.

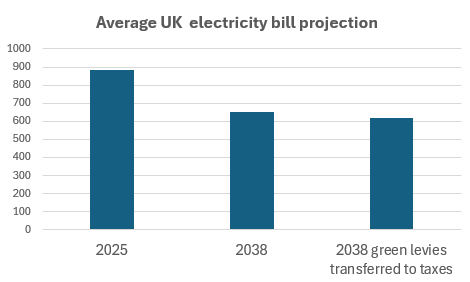

The projected price reduction can be seen in Figure 6 below. This shows that electricity prices decline by 26 per cent. Electricity prices would decline by 30 per cent if, also, the residual ‘green levies’ were taken into taxation.

Note that the upper percentage price reduction involves the residue of the ‘green levies’ being moved on to general taxation. The bulk of the green levies, consisting of legacy renewable energy, will have been paid by then. This leaves energy conservation measures and payments to support fuel-poor families (currently about £2 billion a year according to the ECIU). But since this mainly affects heating powered by gas, it is anomalous to have this on the electricity bill. Of course, the state’s budget for insulation needs to be massively increased as both an anti-fuel poverty measure and a carbon reduction measure.

Figure 6

Source of data, HERE, HERE and also HERE

In making the calculations underpinning Figure 6, I take account I have taken into account the increased costs associated with Hinkley C, which I expect to be generating in 2035. A much lower cost involves the need to finance cost-reducing development of floating wind technology. There are enough resources of fixed offshore wind to power total development needs until the late 2030s, alongside onshore solar and wind.

There have been two basic suggestions for fundamental change to the electricity system to reduce prices. One is having separate markets for fossil fuels and non-fossil fuels. Another is zonal pricing. However, both are complex, will produce uncertainty for several years (which we do not need), and may well have (negative) unintended consequences.

I believe that in the current context of the UK electricity market, it is much better to implement incremental changes to achieve the renewables + batteries strategy. This includes planning grid connections and incentives for battery deployment to help renewables install where there are the best wind/solar, land, and grid connections for them. OFGEM and NESO have put in place a system for ameliorating the logjam in assets requiring grid connections.

Conclusion

The strategy of having an electricity system based on renewables plus batteries achieves the best of all worlds. It lowers electricity prices for consumers (by at least a quarter as discussed here), as well as achieving ever-higher levels of decarbonisation. The reliance on renewables rather than fossil fuels also protects consumers from the impacts of fossil fuel-based energy crises and their associated price spikes. What is not to like?

Acknowledgement: Thanks to Ian Fairlie for contributing to the headline for this post

David. Interesting article, always intriguing how you and David Turver look at the same data and see different causes. But that is what makes the debate interesting.

Some questions.

Can you comment on figure 1. Gas prices peak in 2014 and decline continuously until around 2021. Yet electricity prices grow over that time. What was the dynamic in that period that meant gas was not setting the price in the way it appears to do before and after it?

In figure 4, the price of the EV battery is shown to fall and continue to fall. I see the logic of expanding this concept to the battery module. In these low price battery cell environments, when does the cost of the ancillary equipment and engineering costs start to dominate the cost so that the actual installed cost doesn’t change much?

Figure 5 on household price of electricity seems to have 2025 at above £1500 per annum. What electrical usage is that based on as it seems near the total number quoted for an energy price cap that covers both gas and electricity?

Thanks.

David, have you come across Kathryn Porter's work? She certainly critical of govt electricity pricing.